prince william county real estate tax rate

PRINCE WILLIAM COUNTY VIRGINIA. How property tax calculated in pwc.

Northern Virginia Region Geography Of Virginia

Prince William County collects on average 09 of a propertys.

. PAY TAXES ONLINE OR BY TELEPHONE. Search 703 792-6000 TTY. If you have questions about this site please email the Real Estate.

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Press 1 for Personal Property Tax. A convenience fee is added to payments by credit or debit card.

Press 2 for Real Estate Tax. You can pay a bill without logging in using this screen. Proceso de pago en espanol.

Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator. When prompted enter Jurisdiction Code 1036 for Prince William County. Prince William County Virginia Home.

Payment by e-check is a free service. Click here pay online. Payments for taxes may be made online or by telephone using a credit or debit card.

Choose Avalara sales tax rate tables by state or look up individual rates by address. Then they get the. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

Enter the Tax Account numbers listed on the billing. Hi the county assesses a land value and an improvements value to get a total value. The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient.

Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. Local real estate tax bills are likely still going. Learn all about Prince William County real estate tax.

On Tuesday night The Prince William Board of County Supervisors adopted its annual budget and a Real Estate tax rate of 1125 per 100 of assessed value for Fiscal Year 2021. At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the. The real estate tax rate for the 2019 tax year is 120 per 100.

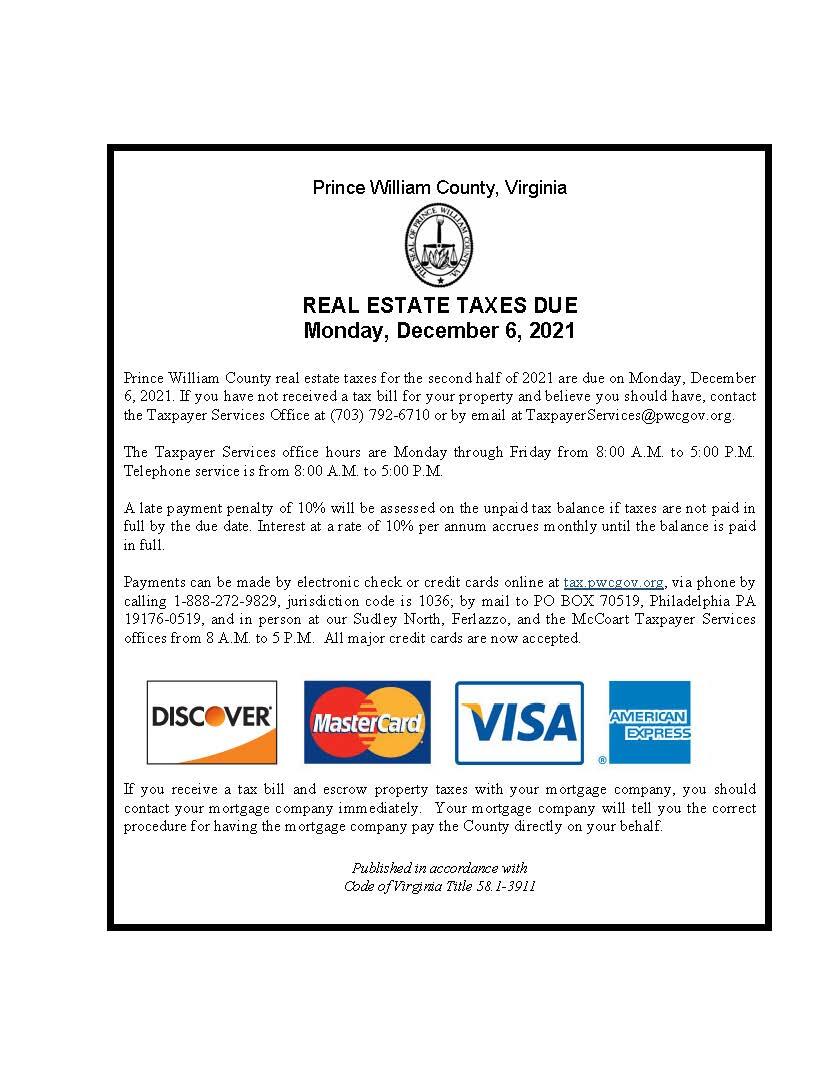

Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue. Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time. All you need is your tax account number and your checkbook or credit card. The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate.

If you have not received a tax bill for your property and believe you should have contact. The Board of County Supervisors voted 5-3 to advertise a real estate tax rate of 1196 per 100 of assessed value for theRead More. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

By creating an account you will have access to balance and account information notifications etc.

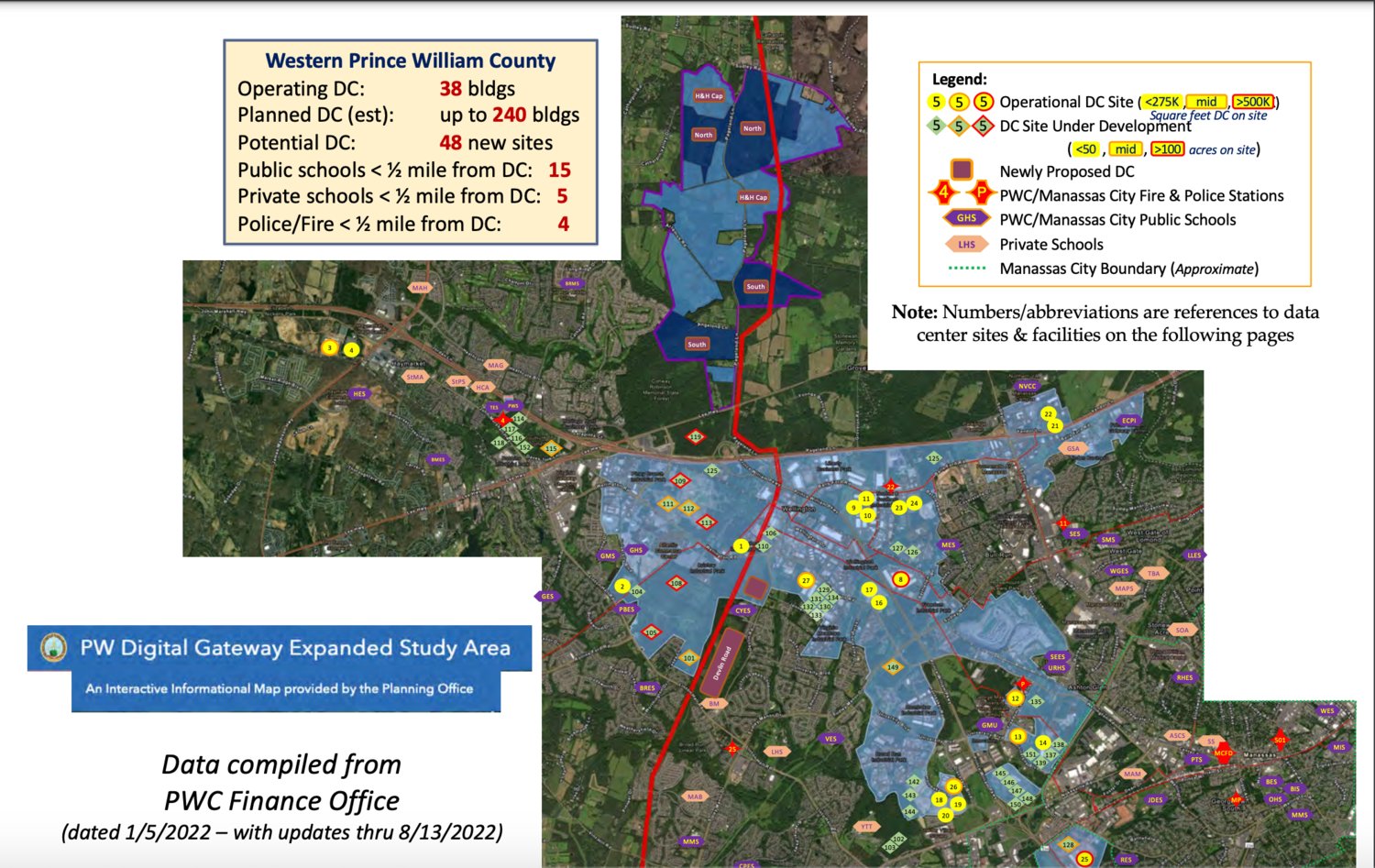

What Is Smart About Smart Growth

Prince William County Taxes Likely To Go Up Again Headlines Insidenova Com

Prince William County Va Businesses For Sale Bizbuysell

Economy In Prince William County Virginia

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

The Rural Area In Prince William County

Nasa Scientist Warns Bristow Area Residents Will Hear New Data Centers Bristow Beat

About Prince William County Virginia Northern Virginia Real Estate The Moyers Team

Facility Event Rental The Prince William County Fair

5 Things Agents Need To Know About The Tax Grievance Process Property Tax Grievance Heller Consultants Tax Grievance

Prince William County Va Land Lots For Sale 70 Listings Zillow

The Prince William County Virginia Local Sales Tax Rate Is A Minimum Of 4 3

Best Places To Live In Prince William County Virginia

Prince William County Va Data Usa

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Could Steal Loudoun S Title Of Data Center Alley But Land Use Battles Are Raging Virginia Mercury

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Real Estate Taxes Due Prince William County Mdash Nextdoor Nextdoor